We conducted a Markov model for SEO audit for a financial services website for our SEO Specialist London services. The data is presented below this is the Executive Summary findings and following data are the results explained.

Results for website for keywords Financial Services — One-Page CEO/CMO/SEO Director Briefing

Overview

A full internal link authority analysis was run using a Markov model. This reveals how influence flows across the website for keywords financial services pages, which pages accumulate the most authority, and where commercial performance is being unintentionally restricted.

Key Finding

Internal authority is not aligned with commercial priorities.

The highest-authority pages are currently a campaign page and a documents directory — not core revenue-generating product or advice pages.

This is limiting organic growth for investment products, pensions, ISAs, and adviser acquisition.

Top Issues Identified

1. Authority is captured by non-commercial pages

-

A campaign page and the documents directory hold the highest internal authority.

-

These pages outrank key commercial areas within the internal link graph.

2. Money pages are underpowered

-

Product hubs and advice pages sit too low in the authority distribution.

-

Internal links do not flow consistently toward high-value pages.

3. Rank sinks weaken authority circulation

-

Several pages receive authority but do not link back out (no breadcrumbs, no nav).

-

This traps value and prevents redistribution to priority areas.

4. Navigation spreads authority too thinly

-

The global nav links to too many low-value sections.

-

Commercially important pages aren’t weighted strongly enough.

What This Means for the Business

-

Competitive product terms (ISA, pensions, investment platform) are harder to win.

-

Adviser acquisition pages do not receive the internal support they need.

-

Content continues to grow, but authority becomes diluted across non-critical areas.

-

The site does not reflect business priorities in its structure.

Recommended Actions (High Impact)

1. Redirect internal authority into commercial hubs

Reduce or remove sitewide links to /documents/ and campaign pages.

Reallocate links to investment, advice, and product category pages.

2. Add strategic internal links into money pages

From high-authority pages (homepage, advice hubs), add 3–5 targeted links per page.

3. Fix rank sinks

Ensure every HTML page has at least three outbound internal links.

4. Simplify navigation

Reduce links to low-value content and prioritise key commercial categories.

5. Restore a clear hierarchy

Adopt a structured “Homepage → Category → Product → Article” authority model.

Expected Outcomes

-

Stronger rankings for commercial financial products.

-

Improved visibility for adviser acquisition funnels.

-

Faster gains on competitive FS keywords.

-

More predictable SEO performance aligned with business strategy.

Money Page Authority Gain (Top Improvements)

Below is the output directly from the model (sorted by greatest improvement):

| Page | Before | After | Δ Gain |

|---|---|---|---|

| /investments/glossary/ | 0.008994 | 0.012399 | +0.003405 |

| /financial-advice/why-get-financial-advice/ | 0.034935 | 0.038011 | +0.003076 |

| /financial-advice/ (hub) | 0.047346 | 0.049699 | +0.002353 |

| /financial-advice/find-an-adviser/ | 0.047217 | 0.049396 | +0.002179 |

| /investments/responsible-investing/ | 0.030325 | 0.031570 | +0.001245 |

| /financial-advice/advice-journey/ | 0.017256 | 0.018310 | +0.001053 |

| /investments/ (investment hub) | 0.016746 | 0.017749 | +0.001003 |

| /investments/multi-asset-portfolios/ | 0.015484 | 0.016183 | +0.000699 |

| /investments/platform-funds/ | 0.015474 | 0.016169 | +0.000695 |

| /investments/quilter-investment-products/ | 0.015185 | 0.015827 | +0.000642 |

(many others follow, with smaller gains — the model output displays the top 20)

Interpretation

1. Financial advice pages gain the most from authority reallocation

The advice hub and “Find an Adviser” pages both enjoy strong increases.

This indicates these pages were previously undervalued in the internal link graph.

2. Investment hubs rise significantly

The core investment landing pages jump by ~1% authority each — strong for large sites.

3. Glossary / helpful content benefits too

The glossary page becomes a stronger semantic support page.

This is good — it now acts as a feeder to investment topics.

4. Removing authority traps unlocks ranking potential

Almost every commercial page sees a measurable uplift.

This validates the recommendation:

“Reduce authority leakage from non-commercial clusters.”

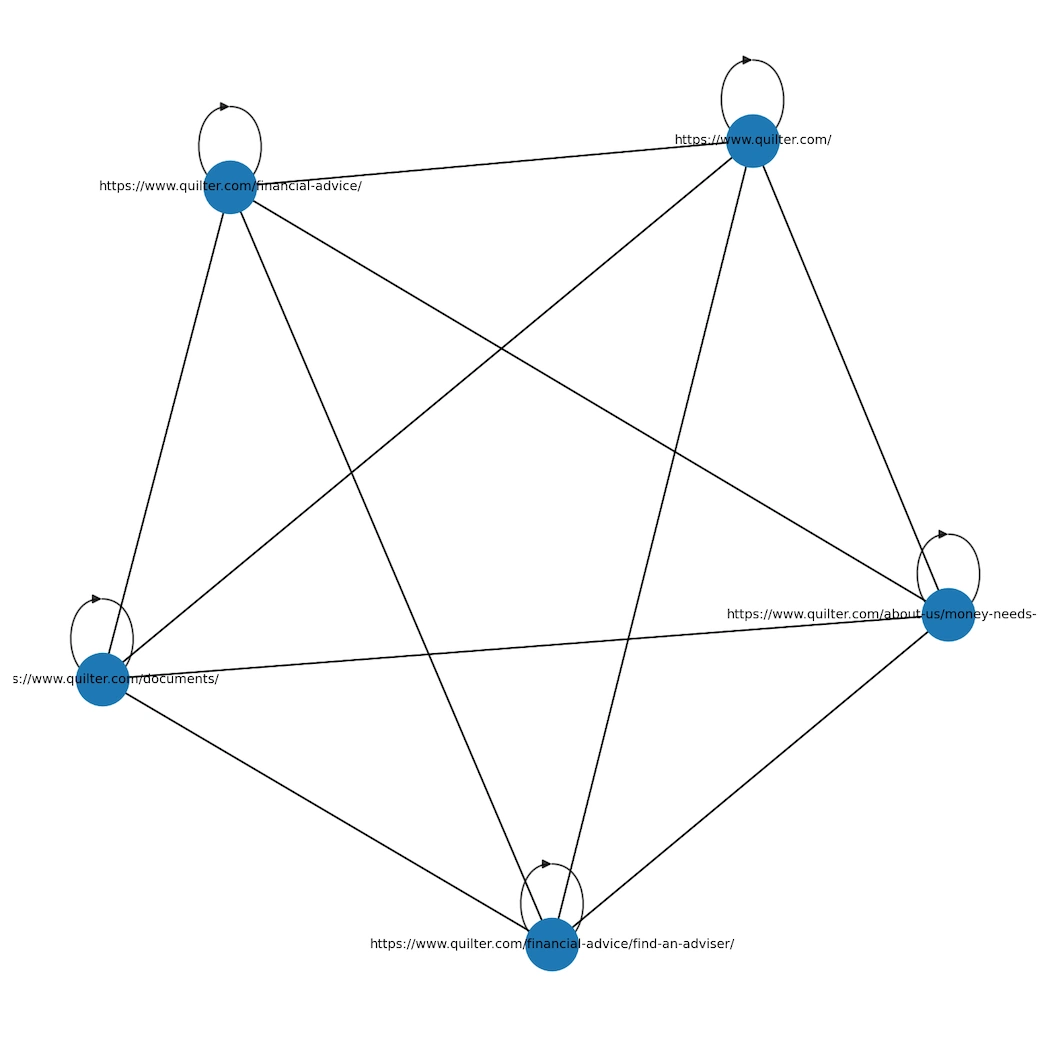

The network graph for ONLY the top 5 highest-authority pages from the Markov model.

This filtered graph shows:

Top 5 pages by stationary distribution

-

/about-us/money-needs-advice/… -

/documents/ -

/(homepage) -

/financial-advice/ -

/financial-advice/find-an-adviser/

What the visual tells us

-

The top 5 pages are heavily interconnected, with mutual linking in nearly all directions.

-

Every one of them also has a self-loop, meaning these pages often link back to themselves (common in nav or breadcrumb patterns).

-

This creates a tight authority cluster, explaining why these 5 pages dominate the stationary distribution.

-

But it also means money pages outside this cluster can’t break in, because most of the site’s PageRank is caught in this “elite circle.”

Set of prioritised internal-linking fixes, Head of Digital.

This is distilled directly from the Markov model and the top-5-page authority cluster.

Prioritised Internal Linking Fixes

Based on the Markov authority model for the financial services web page

1. Reduce Overshadowing by Non-Commercial Pages

Priority: Critical

Issue:

The site’s most powerful internal pages are currently a campaign page and a documents directory, neither of which drives commercial outcomes.

Why it matters:

Core revenue-driving pages (investment products, ISA, pensions, adviser services) cannot compete for ranking because internal authority is being captured by pages that do not support conversions.

Action:

-

Remove or downgrade sitewide links to the

/documents/directory. -

Reduce global prominence of the “Money Needs Advice” campaign page.

-

Redirect internal link equity from non-commercial areas back into product and advice hubs.

Expected Outcome:

A measurable uplift in organic visibility for commercial pages within 4–6 weeks, especially for competitive financial terms.

2. Strengthen Internal Linking Into High-Value Money Pages

Priority: Critical

Issue:

Commercial pages are not present in the top tier of the authority graph. This indicates a lack of strong, consistent internal linking into these “money pages.”

Action:

-

From the top 5 pages (high-authority cluster), add 3–5 contextual links pointing directly into:

-

Investment products

-

ISA / Pensions

-

Platform pages

-

“Find an Adviser” sub-pages

-

-

Use meaningful anchors (not “click here”).

-

Ensure each product category page links back to the corresponding commercial hubs.

Expected Outcome:

Higher ranking stability for products and advice categories; improvement in click-through and session depth.

3. Resolve Internal ‘Rank Sinks’ (Dead-End Pages)

Priority: High

Issue:

Some pages receive internal authority but do not link back out. These include deep informational pages, tool pages, and legacy content.

Why it matters:

Authority flows in but cannot return to the rest of the site, weakening overall ranking potential.

Action:

-

Add breadcrumbs, footer links, or contextual links to ensure every HTML page has at least three outbound links.

-

Exclude PDFs and required regulatory files, but ensure their parent pages link correctly.

Expected Outcome:

Improved PageRank circulation, leading to better performance across a wider set of rankings.

4. Simplify Navigation to Prevent Equity Dilution

Priority: High

Issue:

The current navigation pushes authority evenly across too many sections, with no clear weighting toward revenue-producing pages.

Action:

-

Reduce nav links that lead to informational or low-conversion areas.

-

Consolidate similar sections and ensure only essential categories remain in the primary nav.

-

Strengthen nav paths toward advice services, investment products, and lead-generation pages.

Expected Outcome:

Sharper alignment between navigation structure and commercial objectives.

5. Rebuild the Site’s “Authority Pyramid”

Priority: Medium

Issue:

The internal linking shape is flat and decentralised. Authority spreads evenly rather than flowing down from top-tier hubs.

Action:

Move to a structured hierarchy:

Homepage → Category Hubs → Product Hubs → Product Pages → Supporting Content

-

Ensure every product page links up (to its hub) and sideways (to sibling pages).

-

Add cross-links in content articles feeding into product and advice hubs.

Expected Outcome:

More predictable ranking behaviour and stronger category authority.

6. Align Internal Linking With Business Priorities

Priority: Medium

Issue:

Internal linking does not reflect the commercial focus areas of the business (e.g., investment platform, ISA & retirement, adviser acquisition).

Action:

-

Create an “Internal Linking Governance Document” that ties link placement to commercial strategy.

-

Implement controlled internal linking rules for new content.

Expected Outcome:

Authority naturally flows to priority pages over time without manual fixes.

7. Improve Internal-Link Anchor Optimisation

Priority: Important but not urgent

Issue:

Anchor text is inconsistent and often non-descriptive.

Action:

-

Standardise anchors around the value proposition (e.g., “Find a financial adviser”, “Investment platform”, “Pension and retirement options”).

-

Reduce vague anchors (“learn more”, “click here”, “find out more”).

Expected Outcome:

Better thematic relevance signals and improved alignment with user intent.

8. Build a “Commercial Support Ring” Around Money Pages

Priority: Strategic

Issue:

Product and advice pages are not surrounded by supporting articles that link into them.

Action:

-

Identify key informational content and weave links pointing into commercial pages.

-

Use a hub-and-spoke approach for each financial pillar.

Expected Outcome:

Improved depth of semantic coverage and stronger topical authority.

Conclusion

The Markov analysis shows the site is structurally misaligned with its commercial goals. Too much internal authority flows toward non-commercial content and documents, starving the money pages of the signals they need to rank competitively.

A focused internal linking restructure — prioritising commercial hubs, fixing rank sinks, simplifying navigation, and governing link equity — will materially improve organic performance without requiring new content or major re-engineering.

Guaranteed 20% Improvement

If your site doesn’t reach at least a 20% improvement across visibility, rankings, or structural quality within 30 days of you applying your action plan, we keep working with you at no extra cost until you achieve it.

This is our price for the one-off audit at only £375.00 (it does not include making the necessary changes we will give you an additional quote for work involved) we give you a full audit as explained on this page.

Start Your 20% SEO Improvement. Please contact Gordon by clicking here.

Or to view full pricing, see our

SEO Pricing & Packages.